The staff editorial is the majority opinion of The Murray State News Editorial Board.

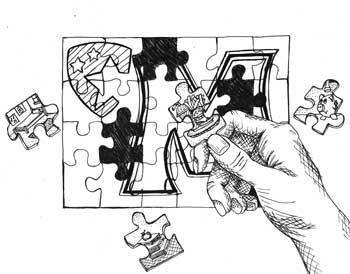

Incoming freshman: these next four, or more, years can make or bankrupt you.

Before you spend your first few weeks here clicking on all the Buzzfeed lists you can find on how to date in college and how to make your dorm room look like the Pinterest corporate office, consider the fact that there are more important things to be researching.

Whether your parents are giving you money each week or you have three jobs to get by, your money is officially your responsibility.

According to FastWeb.com, an online platform offering scholarship, financial aid, college search and career resources, the Department of Education acquired upwards of $101.8 billion from student loan borrowers between 2008 and 2013. Between 2005 and 2013, student loan debt increased by nearly 300 percent.

Those numbers will only go up from there.

So, before you put yourself in a cycle where you live paycheck to paycheck and run out of flex by October, start budgeting now.

There are so many ways to avoid being one of those alarming student debt statistics.

Know what you’re getting into when you click “Accept” on those tempting financial aid offers. There is a big difference between a subsidized and unsubsidized loan: the amount of interest you’ll have to pay on the loans upon graduation.

According to Edvisors.com, subsidized loans have periods of authorized deferment, allowing the government to pay interest on your loans while you’re in school or experiencing times of economic hardship. Unsubsidized loans place the entire responsibility of interest payments in the borrower’s hands.

To avoid shackling yourself to student loan payments, try to get most of your higher education paid for by scholarships and grants.

You don’t have to have a 4.8 GPA and 600 hours of volunteer service to have your education paid for, without interest.

You can apply for scholarships with qualifications ranging from being left-handed to having red hair. Apply for as many as you can find.

FastWeb, Unigo and Scholarships.com are just a few of the options available. Murray State also offers resources year-round for students – it’s time consuming, but wouldn’t you rather fill out a bunch of applications than file for bankruptcy?

Start now.

Be realistic about your budget – know the difference between your needs and wants.

When setting the dollar amount for your income, set it low. When setting the dollar amount for potential expenses, set it high. It may seem counterproductive, but your savings account will thank you.

Take your student ID with you everywhere you go. Aside from getting you into the residential colleges and paying for your on-campus meals, it will get you discounts at a surprising number of stores and restaurants in Murray.

Stash those coupon books being handed out on campus somewhere easily accessible. Shop at Dollar Tree, Dollar General and consignment stores.

Put the $8 you were about to spend on a fast food bedtime snack back in your wallet. Save the $45 you were thinking about spending on a monogrammed crop top for later. If the barista says, “Venti mocha frap with two shots of espresso,” before you have a chance to speak, rethink your flex spending decisions.

College might very well be the best four years of your life. However, how you manage your money during that time will determine how good or bad the years after graduation will be.