$417 billion.

College student spending takes up almost half a trillion dollars of the U.S. economy a year.

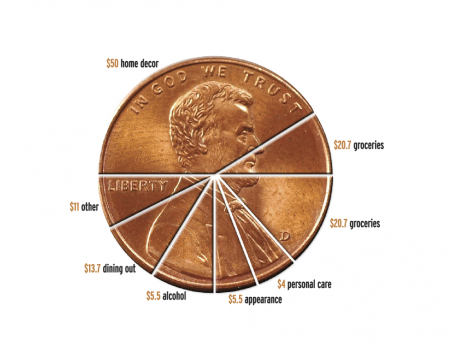

While a large amount of this money goes to college tuition, room and board and school expenses, $120 billion is purely discretionary. That means groceries, alcohol, dining and appearance are among the several categories of spending increases in college students every year.

Megan Dolan, senior from St. Charles, Mo., said she spends most of her money on gas driving to campus everyday, even though she lives less than five miles from campus. She has used a credit card since her first year at Murray State and decided recently to acquire one under her name.

“I always pay my minimum payments and I’ve never missed one, but I’ve definitely collected debt,” Dolan said. “When I quit my job, I had no way of paying it off.”

According to a study performed by Sallie Mae, a college-financing company, an average student with at least one credit card will graduate $4,138 in debt. The study also says 84 percent of students own at least one credit card.

In 2012, Time Magazine reported fewer than 10 percent of students pay their balance in full every month. Only 15 percent know their interest rate, and 92 percent of students surveyed were business majors.

Chris Johnson, relationship banker at BB&T, said students do not seem to understand how detrimental credit card debt can be.

“It may not seem that important now, but when (students) get out of college and want to buy a car, their credit is coming back to bite them,” Johnson said.

Although studies show three out of every four college students have jobs, it may not be enough to pay off credit card and student loan debt. Dolan said she had to quit her job when it started interfering with her grades.

As part of discretionary spending, many students also overindulge when it comes to food. The Huffington Post reported 20 percent of students often eat at dining halls, while another 20 percent prefer eating out. The average student in 2011 spent $765 eating off campus.

Nearly a fourth of all enrolled Murray State students are currently on the unlimited meal plan at Winslow Dining Hall. The bronze package with 385 flex dollars is the second-highest purchased meal plan at the University.

The students who tend to purchase high-flex dollar packages are those commuting to campus. Commuters at Murray State usually only eat one meal, if that, on campus.

Kathy Kopperud, a real estate agent in Murray, said students must consider several factors before deciding whether or not to live on campus. At Murray State, in-state students must spend their freshman and sophomore years on campus.

“Students need to be careful to find out what utilities might cost before committing to a rental because an older home or poorly insulated apartment could range into several hundred dollars,” Kopperud said.

Kopperud said the average Murray apartment costs $375 a month, with some of the utilities already paid.

While an apartment may be cheaper monthly than a Murray State residential college room, transportation to campus can often fill that gap. According to the Huffington Post, students spend an average of $1,082 a year on gas used driving to campus.

Students also tend to gain parking tickets frequently, which add up tremendously over time. Last year, Murray State gave away 15,620 parking tickets of $15 or $30 values.

The $15 tickets are given to students who park in the wrong zone, while the $30 dollar tickets are given to students who park in the wrong zone without a parking pass in their rearview mirror.

If only a fourth of the tickets given out last year were $30, the rest $15, Murray State gained $300,000 just from parking violations.

Story by Lexy Gross, Assistant News Editor.